Estimated 2022 tax brackets

These are the rates for. You expect your withholding and refundable credits to be less than the.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

10 12 22 24 32 35 and 37.

. Your bracket depends on your taxable income and filing status. You expect to owe at least 1000 in tax for 2022 after subtracting your withholding and refundable credits. For married taxpayers filing.

2021 Tax Brackets and Rates. The filing status for this option is Married Filing Separately. 7 rows 2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married.

Start Crafting Money-Saving Tax Strategies for Clients with Our 2023 Projected Tax Rates. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Once you have a better understanding how your 2022 taxes will work out plan accordingly.

The 2022 IRMAA brackets have increased by roughly 345 from 2022 with the exception of the highest bracket. 2022 Form NC-40pdf. There are seven federal tax brackets for the 2021 tax year.

WASHINGTON The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals retirees investors. Individual Estimated Income Tax. 8 rows 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax.

Those earning between 13900 and 215400 are subject to marginal tax decreases as the corresponding rates decreased from 59 percent and 633 percent to 585. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying. You estimate that your tax after withholding and credits including refundable credits will be 1000 or more.

Your tax bracket is. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing.

2021 2022 Tax Brackets by Filing Status. Progressive Tax Rates This person is in the 22 tax. Ad Access Tax Forms.

This 2022 tax return and refund estimator provides you with detailed tax results. IR-2022-77 April 6 2022. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

In most cases you must make estimated tax payments for tax year 2022 if. Standard Deduction for 2022 Federal Income Tax. The 2022 tax calculator uses the 2022 federal tax tables and 2022 federal tax tables you can view the latest tax tables and historical tax tables used in our tax and salary.

Estimate your tax refund with HR Blocks free income tax calculator. For example in 2021 a single filer with taxable income of 100000 will. Enter your tax year filing status and taxable income to calculate your estimated tax rate.

For single taxpayers and heads of household it will be phased out ratably for MAGI between 138000 and 153000 129000 and 144000 in 2022. It doesnt affect the income in the previous brackets. PDF 49105 KB - January 24 2022.

Complete Edit or Print Tax Forms Instantly. The 0 rate applies to. Ad Get Your Copy of Bloomberg Taxs 2023 Projected US Tax Rates Special Report.

For tax year 2022 the 20 rate applies to amounts above 13700. For example someone single with a 60000 AGI in 2022 will pay. If you are married you have the choice to file separate returns.

The 0 and 15 rates continue to apply to amounts below certain threshold amounts. Your marginal tax rate or tax bracket refers only to your highest tax ratethe last tax rate your income is subject to. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

We suggest you not only look at the many tax. 14 rows The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Federal Income Tax Brackets Brilliant Tax

2022 Income Tax Brackets And The New Ideal Income

Paying Self Employment Tax For The First Time In 2022 Credit Karma Credit Counseling Tax Debt Relief

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Federal Income Tax Brackets Brilliant Tax

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

2022 Income Tax Brackets And The New Ideal Income

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

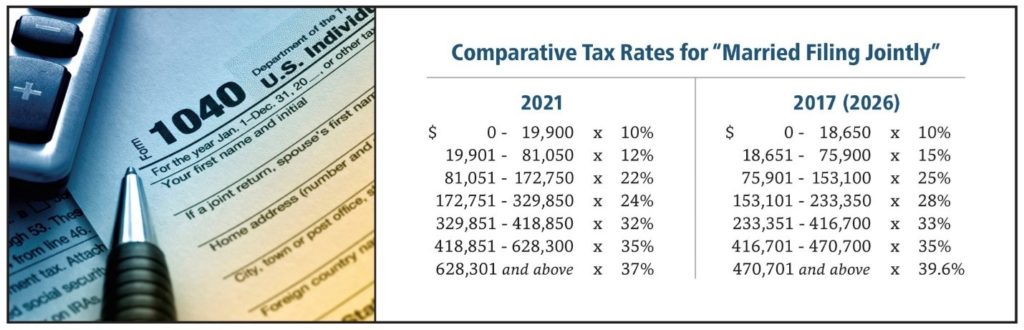

Start Planning Now For A Higher Tax Environment Pay Taxes Later

Estimated Payments Or Withholding In Retirement Here S Some Guidance Kiplinger In 2022 Capital Gains Tax Capital Gain Tax Mistakes

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

2022 Income Tax Brackets And The New Ideal Income